Lending

Products

Access to a broad range of personal and business lending options, paired with strategic guidance.

Strategic Capital Solutions for Every Stage of Growth

At FundFi, we provide access to a broad range of personal and business lending options, paired with strategic guidance to help businesses choose the right capital structure for your goals, timing, and financial profile.

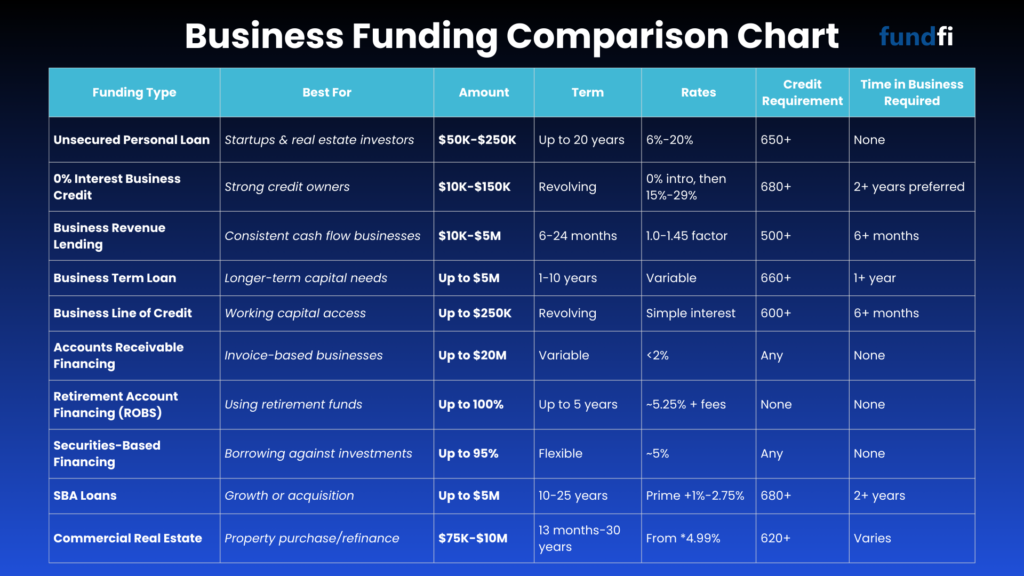

We do not believe in one-size-fits-all financing. Each product serves a different purpose depending on credit profile, cash flow, growth stage, and risk tolerance. fundfi helps clients understand how each option works, where it fits, and how funding decisions today impact long-term flexibility and cost of capital.

Personal Loans

Personal loans may be used strategically for business purposes in certain scenarios, including early-stage funding, consolidation, or bridge capital. These options typically rely on personal credit strength and may offer fixed terms and predictable repayment.

SBA 7 (a) & Business Term Loans

Supporting borrowers with strategic funding guidance, tailored solutions, and clear expectations from application to approval.

SBA 7(a) Loans

SBA 7(a) loans are government-backed financing options designed for established businesses seeking longer terms and lower rates. These loans require detailed documentation, underwriting, and patience, but can support expansion, acquisitions, or refinancing.

Business Term Loans

Business term loans provide lump-sum capital with fixed repayment schedules. They are commonly used for growth investments, equipment, or restructuring, and are underwritten based on credit, cash flow, and business stability.

0% Credit Card Stacking

0% credit card stacking uses introductory interest offers across multiple cards to create short-term, interest-free capital when structured properly. This option requires strong personal credit and disciplined repayment planning to avoid long-term cost escalation.

Business Lines of Credit

Lines of credit offer revolving access to capital, allowing businesses to draw funds as needed and pay interest only on what is used. This option supports cash flow management, seasonal expenses, and working capital needs.

Merchant Cash Advance

Merchant cash advances provide access to capital based on revenue performance rather than traditional credit metrics. While flexible, these products carry higher costs and are best used selectively for short-term operational needs.

Commercial Real Estate Financing

Commercial real estate financing supports property acquisition, refinancing, and development for owner-occupied and investment properties. These products involve longer timelines, higher documentation standards, and property-specific underwriting.

Funding Questions, Answered.

Everything you need to know about the application process, approval strategy, and next steps.

How long does the funding process take?

Most clients receive initial approvals within 24 to 72 hours, depending on profile strength and program selection.

Does applying hurt my credit score?

No. The initial review uses a soft pull and does not impact your credit score.

What credit score do I need to qualify?

A score of 680 or higher is ideal, but options exist for lower scores depending on revenue, structure, and overall fundability.

Can startups with no revenue qualify?

Yes. Several programs are available for new and pre-revenue businesses.

Do you guarantee funding?

No company can ethically guarantee funding. FundFi guarantees a proven, strategy-driven process designed to maximize approvals.

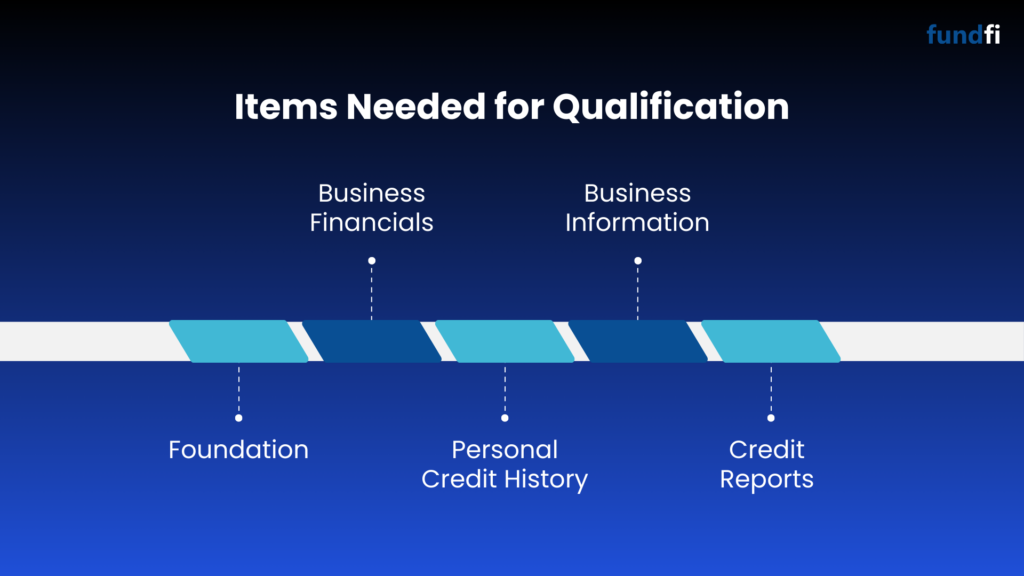

What documents are required?

Personal documentation typically includes identification and credit profile access.

Business documentation may include bank statements, entity formation documents, and financials depending on the program.

How is FundFi different from a bank?

Banks offer a single product. FundFi provides access to multiple lenders and funding structures to increase approval odds and capital amounts.

Do you work nationwide?

Yes. FundFi serves clients across all U.S. states.

Can I combine multiple funding types?

Yes. Many clients secure multiple approvals simultaneously as part of a coordinated funding strategy.

Start Your Customized Funding Strategy

Begin Your Funding Strategy

Apply today to begin a strategic, underwriting-aligned funding process built for long-term success.